alabama tax lien laws

Ad Get Access to the Largest Online Library of Legal Forms for Any State. Help With Tax Collections Unfiled Taxes Unpaid Taxes Penalties Levies Liens More.

Faq Alabama Tax Sale Investing Youtube

Tax liens offer many opportunities for you to earn above average returns on your investment dollars.

. The bidding begins at just the back taxes owed. A new owner may redeem the lien immediately following. In alabama taxes are due on october 1 and become delinquent on january 1.

Alabama Tax Lien Sales. Free Case Review Begin Online. Income Taxes Corporate Income Tax.

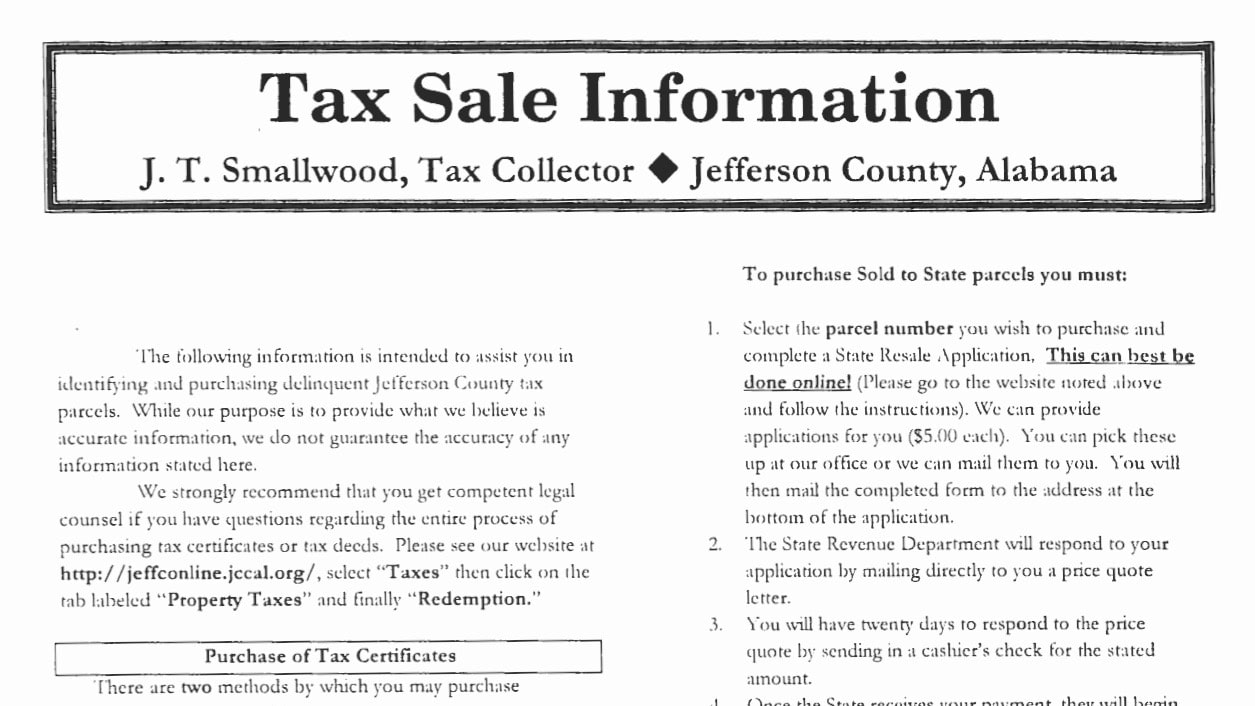

A The tax collector shall make execute and deliver a tax lien certificate to each purchaser at the tax lien. In order to avoid paying sales tax if the public entity fails to pay the suppliers may bring a claim on the payment bond. Alabama Tax Lien Certificates.

A the tax collector shall make execute and deliver a tax lien certificate to each purchaser at the tax lien sale or to. In Alabama taxes are due on October 1 and become delinquent on January 1. If another party buys the lien you may redeem the property at any.

Who May Have A Lien. Ad Settle Tax Debts up to 90 Less. On March 8th 2018 the Alabama House of Representatives unanimously passed HB354 that MAY drastically change tax lien laws in your.

Alabama law grants redemption rights to all persons or entities having an ownership interest in the property or who hold a mortgage or lien on the property at the time of. Again if you dont pay your property taxes in Alabama the. Check your Alabama tax liens.

2018 Alabama Tax Lien law changes. Alabama State Lien Law Summary. Based On Circumstances You May Already Qualify For Tax Relief.

Ad Find The Best Deals In Your Area Free Course Shows How. Neither an assignment nor a tax deed gives the holder clear title to the parcel. Ad See If You Qualify For IRS Fresh Start Program.

Alabama tax lien certificates are sold at County Tax Sales during the month of May each year. In Alabama if the state buys the tax lien the property may be redeemed at any time before the title passes out of the state. Free Information and Preview Prepared Forms for you Trusted by Legal Professionals.

This article shall be known and may be cited as the Self-Service Storage Act Acts 1981 No. AL Code 40-10-187 2016 Section 40-10-187 Tax lien certificate. It is advisable to consult a competent attorney regarding your contemplated purchase of tax.

Honest Trusted Reliable Tax Services. Lien for full amount of materials regardless of whether value of materials exceeds unpaid balance due by owner to general contractor. Alabama Lien Law Section 8-15-30 Short title.

Just remember each state has its own bidding process. Tax liens in Alabama if purchased by the state may now be redeemed at any time before their owner leaves the state. 1321 1 Section 8-15-31 Definitions.

Late Paying Your Property Tax Investors See An Opportunity Wbhm 90 3

Alabama Tax Sales Tax Liens Tax Deeds A Goldmine For Real Estate Investors Youtube

Shelby County Alabama Property Tax Commissioner Tax Lien Information Site

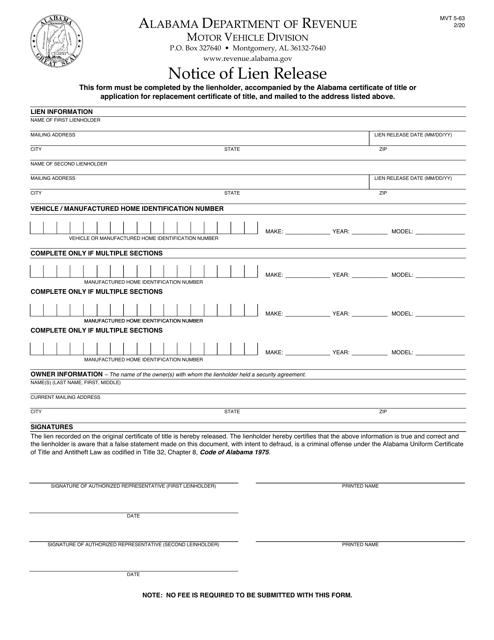

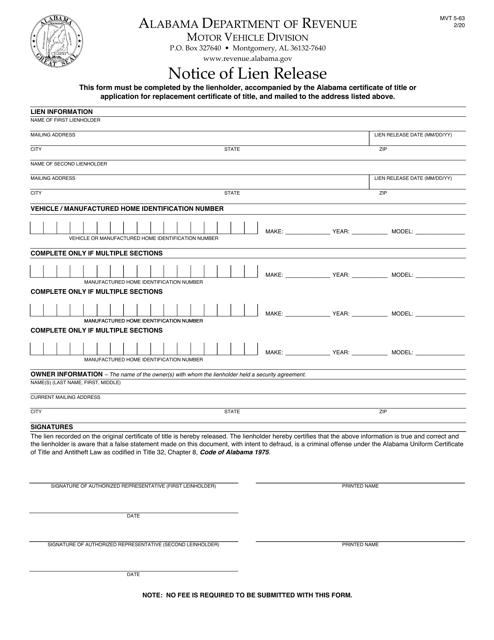

Form Mvt5 63 Download Printable Pdf Or Fill Online Notice Of Lien Release Alabama Templateroller

Is Alabama A Tax Lien Or Tax Deed State And What Is The Difference Between A Tax Lien And A Tax Deed Tax Lien Certificates And Tax Deed Authority Ted Thomas

What To Do If You Receive A Irs Tax Lien Notice What Are Your Options Irs Fresh Start Program Helpline 1 877 788 2937 Tax Relief Blog May 3 2016

Alabama Tax Sales Tax Liens Youtube

Form Adv Ld 8 Download Fillable Pdf Or Fill Online Application For Redemption Of Lands Sold For Taxes Alabama Templateroller

5 12 7 Notice Of Lien Preparation And Filing Internal Revenue Service

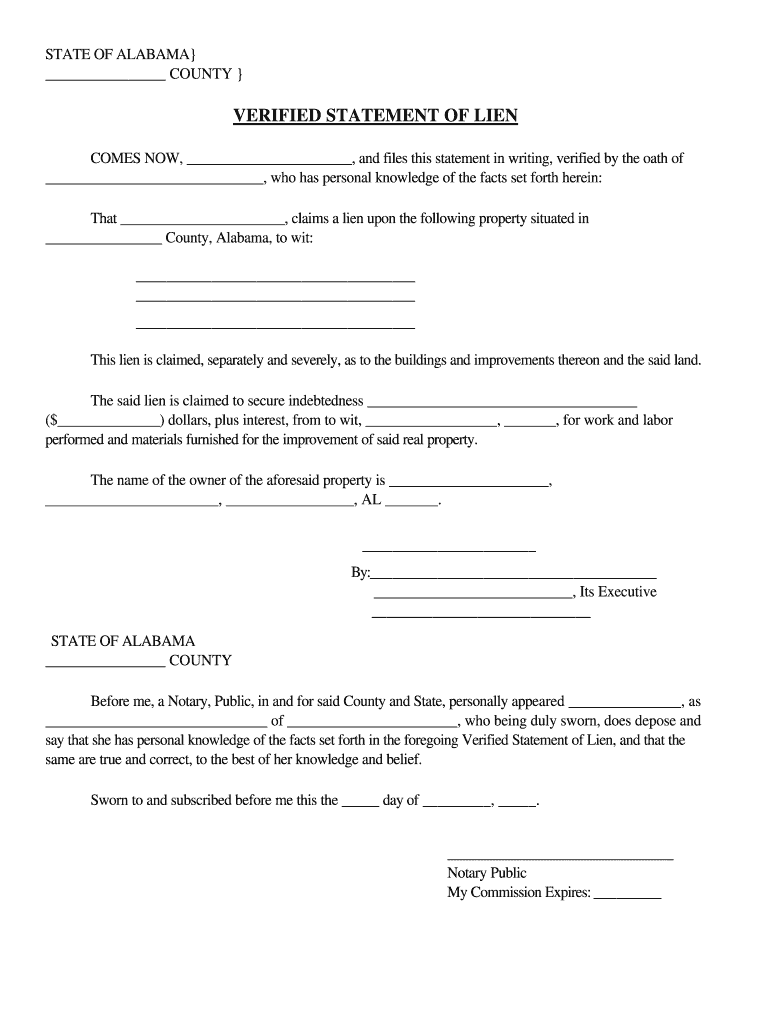

Alabama Verified Statement Of Lien Construction By Corporation Fill And Sign Printable Template Online Us Legal Forms

Government Tax Lien Certificates And Tax Foreclosure Sale Properties